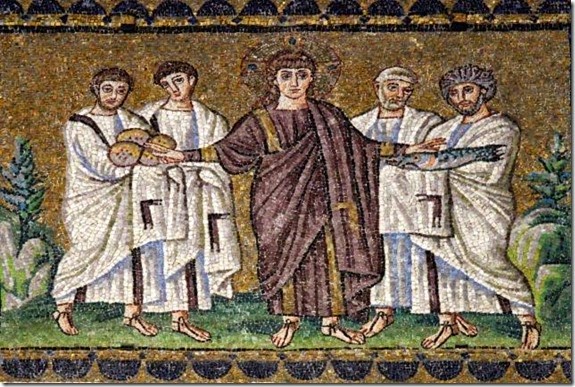

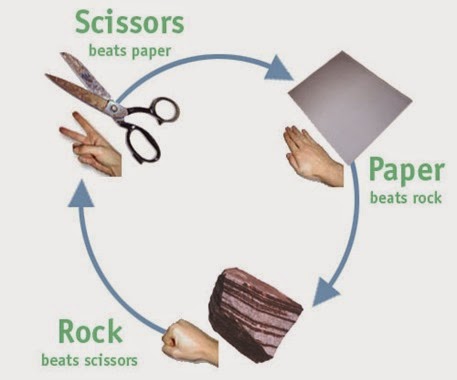

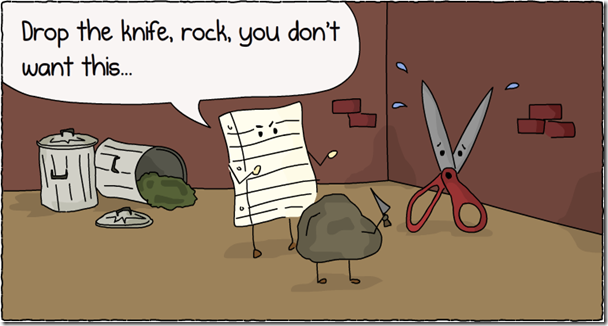

The Miracle of May 12: Greece manages to make €757 million IMF payment (fish: right) while continuing to pay domestic salaries and pensions (loaves: left). Informed observers attribute it to the Salvation of Salonika. But for how much longer can the multitudes be fed?

The Greek game of turkey continues to astonish us. The Greek government authorized the transfer this morning of the €757 million it owes to the IMF, thus avoiding default, producing a Miracle of May 12 and continuing to defy worldwide expectations (including our own).

How, and especially, why, is it doing it? First, there is the Salvation of Salonika, where the mayor of Greece’s second largest city, Thessaloniki, alone among major Greece municipalities, transferred the city’s cash reserves to the Greek Central Bank:

Thessaloniki Mayor Yiannis Boutaris believes that the government’s behavior is “completely crazy” but he has nevertheless led the way among peers in transferring his municipality’s cash reserves to the Bank of Greece, where the government can use them for short-term borrowing.

“It is very important that we show this municipality understands what will happen to the country,” Boutaris told the municipal council on Tuesday ahead of a vote on the matter. “We are not doing the government a favor; we are supporting the country.”

However, Boutaris admitted that he does not see eye to eye with the coalition on the way it has handled negotiations with the institutions. “The government does not speak the same language as those it is negotiating with,” he told Kathimerini. “That is why they cannot understand each other.”

Second, in its obsession with providing “the institutions” (aka troika) with no pretext for throwing it out of the Eurozone as part of its larger game-of-turkey strategy, it apparently has been indulging in its own variety of turbo-austerity—temporarily boosting its fiscal surplus by delaying payments to suppliers and investment projects (see Peter Spiegel at FT.com and the Greek budget analysis by Silvia Merler at breugel).

Greek Finance Minister and media superstar Yanis Varoufakis, rebounding from his recent sidelining, reiterates that Greece, despite its financial difficulties, will not cross “red lines” regarding pension cuts and reforms to collective bargaining. Nevertheless, he freely admits that Greece is facing a liquidity crisis within “a couple of weeks.”

German Finance Minister Wolfgang Schäuble, for his part, has made a surprising counter in his game-of-turkey hand by now allowing for a Greek referendum to decide whether the country will remain in the Eurozone and accept further austerity and painful “structural reforms.” Recall that an attempt by then Prime Minister Papandreou in 2011 to hold a similar referendum was immediately torpedoed by explicit threats of French President Sarkozy and German Chancellor Merkel to summarily expel Greece from the Eurozone, and soon brought down his government. Peter Schwarz on the World Socialist Website characterized this incident as follows:

The way Papandreou was forced to retreat—and possibly to resign—has all the hallmarks of a political coup. It demonstrates that the austerity measures implemented by the European Union to save the euro and the banks are incompatible with democratic principles.

That Schäuble now displays such a conciliatory attitude to a Greek referendum may be indicative of just how far the Germans have come in their game of turkey. That is, they now want Greece out, but, like all other participants in this game, don’t want to have any egg left on their face afterwards. This is something for the Greek people themselves, since their government has been skillfully playing its hand in this game of turkey as a war of attrition by making Herculean efforts to avoid default while not betraying its electoral mandate.

But on a more personal level, Schäuble took pains to defend his much maligned Greek counterpart in a recent interview in the Frankfurter Allgemeine (my translation):

We are both finance ministers and bear responsibility, and thus we work well together. The media first built Varoufakis up into a superstar and now they have been dressing him down. Each is as misplaced as the other.

Update 17:35 CET: Unfortunately, Max Weber’s Entzauberung der Welt (disenchantment of the world) once again seems to be triumphant in our enlightened age, relegating the Salvation of Salonika to the rubbish heap of religious myths. The Financial Times reports at 14:41 CET that Greece actually plundered its emergency account at the IMF (apparently with the latter’s connivance) to the tune of €650 million to meet today’s Miracle of May 12 repayment. According to the FT, “Without the additional cash the government would not have been able to repay the loan instalment and also disburse nearly €1bn on Wednesday to pay public sector salaries, another official said.”

Is there no solace left for the spiritually inclined in our disenchanted meltdown creation?

Of course this can only mean that the prophesized “Grexit, Graccident, Grone” moment looms even nearer when Greek salaries and pensions—the miracle of the loaves—also comes under threat of disenchantment before the end of the month. Or can there still be a Eurogroup epiphany?