The memorial plaque at the Sant’Anna di Stazzema National Peace Park bearing the names of the 560 victims of the August 12, 1944 massacre perpetrated by the Waffen-SS, was destroyed by a windstorm on March 5 of this year. I visited the site on May 21 with my colleague Alessandro Nuvolari (right) during my annual teaching stint at the Scuola Superiore Sant’Anna in Pisa. The self-destruction of the plaque is hauntingly symbolic of the current contradictions of the European project.

Rivers of (real and virtual) ink are now being spilled on the denouement of the seemingly never-ending Greek debt crisis, but one thing you can’t help but give both the creditors and the debtors nations credit for—they have succeeded in providing continuing high drama and suspense right down to the wire, something not otherwise characteristic of the staid European Union, whose official goals until now have been peace, stability, and mutual prosperity and understanding. I don’t think Europe has experienced such a sustained buildup of public diplomatic brinkmanship since the ill-fated Munich Agreement negotiations of September, 1938 that led to the dismemberment of Czechoslovakia (see Jean-Paul Sartre's The Reprieve—French original title Le Sursis—for a breathless rendition of this earlier media-age cliffhanger). But of course I do not mean to insinuate that there is any analogy between the actors and issues then and now, even if some might argue (such as Wolfgang Münchau in the FT and Spiegel Online) that, with the credibility of the currency union hanging in the balance, almost as much is ultimately at stake.

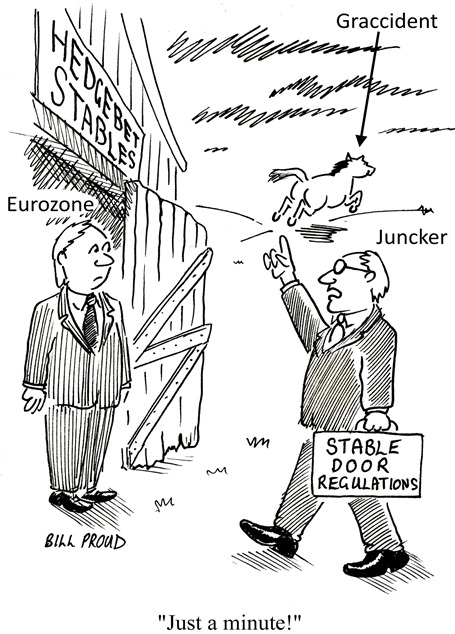

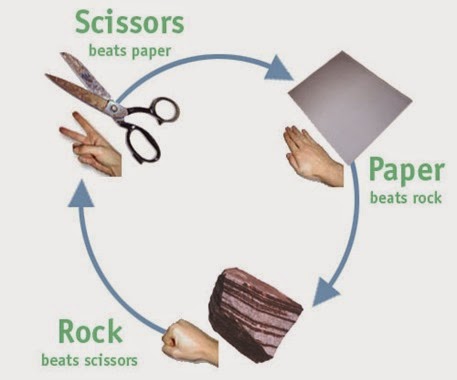

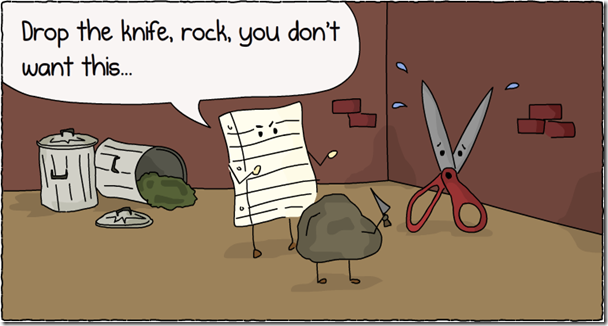

And I also do not want to reiterate here the many arguments pro and contra on the various positions and conspiracy theories now circulating (see Project Syndicate’s or VoxEU.org for research economists’ views, for example), except to say that regardless of the outcome (Grexit/Graccident/capitulation to a temporizing compromise/collapse of the Greek government), there will be no winners, and only serious losses of credibility and capital for the Eurozone, possibly not stopping at its unraveling. The proverb “it’s an ill wind that blows nobody any good” actually suggests that there can be winds so pernicious that there is no redeeming value to anyone, and that certainly seems to be the case in the Greek debt crisis. Another temporizing compromise will not lead to a revival of Greek economic activity precisely because, aside from continuing austerity, it will not remove the inhibiting threat of Grexit currency and default risk for more than a few months. And while a properly managed Grexit implying devaluation and default, after initial sharp turmoil, might allow Greece to regain monetary and fiscal sovereignty and a growth perspective, the creditor losses will vastly exceed those an appropriate debt restructuring would have entailed (in 2010, 2012, or even now), and reopen the Pandora’s Box of illiquidity risk, spread explosion, and further Euro exits that Mario Draghi seemed to have magically banished in 2012 with OMT. And even if the remaining Eurozone countries circle the wagons around the German austerity project and impose punitive measure against Greece as a warning to anti-austerity populists at the gate in Spain, Ireland, France or Italy, the European idea will have been discredited as a humanitarian project.

For that humanitarian project was initiated precisely to transcend forever the depths of depravity the massacre at Sant’Anna di Stazzema showed European were capable of towards each other a mere 70 years ago. On Aug. 12, 1944, a troop of Waffen-SS, ostensibly searching for Italian partisans, systematically massacred 560 civilians in the village, although it was located outside of the zone of active hostilities and was crowded with refugees. Spike Lee’s underrated 2008 film Miracle at St. Anna combines these historical events with the battlefield plight of an Afro-American platoon of the segregated 92nd ‘Buffalo’ Infantry Division. Filmed on location, the plot, based on the novel of the same name by James McBride, takes some historical liberties by introducing a fictional Judas-like partisan traitor, provoking controversy in Italian during its first screening there, but is otherwise remarkably faithful to the known facts.

The village church at Sant’Anna di Stazzema today, principal site of the massacre and its reenactment in Spike Lee’s film. Billy Budd, senior military adviser to the film: “When we shot the massacre scene at Sant’Anna di Stazzema, on the very ground where this atrocity occurred - I’ll tell you, there was not a dry eye in the house at the end of that day.”

The summer of 1944 saw a number of such massacres in German-occupied Europe committed mainly by Waffen-SS units, such as Oradour-sur-Glane in France and Distomo in Greece. While these units invoked retribution for partisan attacks as their justification, it was soon clear to the Wehrmacht command, even in the Draconian context of Nazi military logic which exacted ten executed civilians for every German soldier killed, that this was only a pretext and that the respective commanders had exceeded their authority. None, however, were brought to justice or even reprimanded by the German command (although there were investigations), and remarkably, few have been brought to justice since by the postwar European democracies. Quite aside from the morality, one wonders why these Waffen-SS units, ideologically fanaticized as they were, even went to the trouble of gratuitously massacring civilians outside the immediate theater of war (in the case of Oradour-sur-Glane, the time lost to the massacre meant the unit arrived at the Normandy front, its actual objective, too late to matter). Yet there is an obvious pattern here, spread out over occupied Europe, that screams for a military-psychological explanation.

The Italian authorities only initiated judicial proceedings in 2004 after the “armadio della vergogna” (“cabinet of shame”) was accidentally discovered in 1994 in the military prosecutor’s office in Rome. It contained evidence about war crimes during World War II that had been hidden away in the interests of the state (primarily not to impede Germany’s entrance into NATO during the cold war and provoke prosecutions of similar Italian war crimes during the Balkan occupation). In 2005 an Italian military court in La Spezia finally found ten Waffen-SS officers guilty of war crimes during the Sant’Anna di Stazzema massacre and sentenced them in absentia to life imprisonment, but German courts in 2010 refused to extradite them to Italy. In the absence of judicial solidarity, German President Gauck stepped into the breech during a 2013 ceremony at the Peace Park.

German and Italian Presidents Gauck and Napolitano displaying European solidarity at a 2013 commemorative service at the Sant’Anna di Stazzema memorial where courts feared to tread. (Picture credit: DW)

The museum at Sant’Anna di Stazzema, besides a very thorough exhibition on the historical background, also shows a number of documentary films, including a recent one based on interviews with survivors of the massacre, who were all children at the time who had managed to hide or flee. One group of survivors recounts in this film that they were taken away from the village to be executed by a group of SS soldiers but after all but one of them were called back to the village, the lone remaining soldier fired his machine gun into the woods and told them to flee. What’s remarkable about this incident is that, despite all the fanatization and combat brutalization, once released from peer pressure and control, even Waffen-SS soldiers were able to display humanity at risk to themselves.

But now back to Greece. Joseph Stiglitz reminds us in a June 5th article that

The future of Europe and the euro now depends on whether the eurozone’s political leaders can combine a modicum of economic understanding with a visionary sense of, and concern for, European solidarity. We are likely to begin finding out the answer to that existential question in the next few weeks.

That time has come this week, but the prospects are not encouraging. Gideon Rachman argued in the Financial Times two days ago that the three main alternative solutions to the Greek debt crisis may all lead to chaos:

But the truth is that all three routes may ultimately lead to the same destination: the destruction of the European single currency. The lengths of the journeys would vary, the scenery along the way would look different but the end point could still be the same.

My guess is that, at least by the weekend, we will be confronted with only one of two immediate outcomes:

Will Greek Prime Minister Alexis Tsipras return to Athens this week with a Brussels Agreement containing “austerity* for our time” lasting as long as British Prime Minister Neville Chamberlain’s 1938 Munich Agreement’s “peace for our time”? (Picture credits left: GLM; right: Wikimedia Commons).

[* Due to Tsipras’s Greek accent, it may not be clear if he says “austerity” or ‘'prosperity.”]

Or will his coalition government simply collapse for lack of any agreement, or lack of parliamentary support for whatever agreement he does bring back?

In any event, it will represent an existential failure of European solidarity for which the destruction by ill winds of the Sant’Anna di Stazzema memorial plaque is a fitting symbol.

PS: Italian Minister Maria Elena Boschi has informed Alessandro Nuvolari in a June 19th email that the rubble of the memorial plaque has now been removed, and that she expects it to be replaced by a new one in time for the forthcoming 71st anniversary of the August 12 massacre.